Brazilian Iron Ore

Brazil has long been recognized as one of the world’s top producers of high-grade iron ore. In 2025, the country remains a critical supplier for global steelmakers seeking consistent quality, large-scale volumes, and optimized logistics.

This article examines why Brazilian iron ore—particularly its premium sinter feed—continues to attract sophisticated international buyers, highlighting recent export figures, metallurgical advantages, and shipping economics.

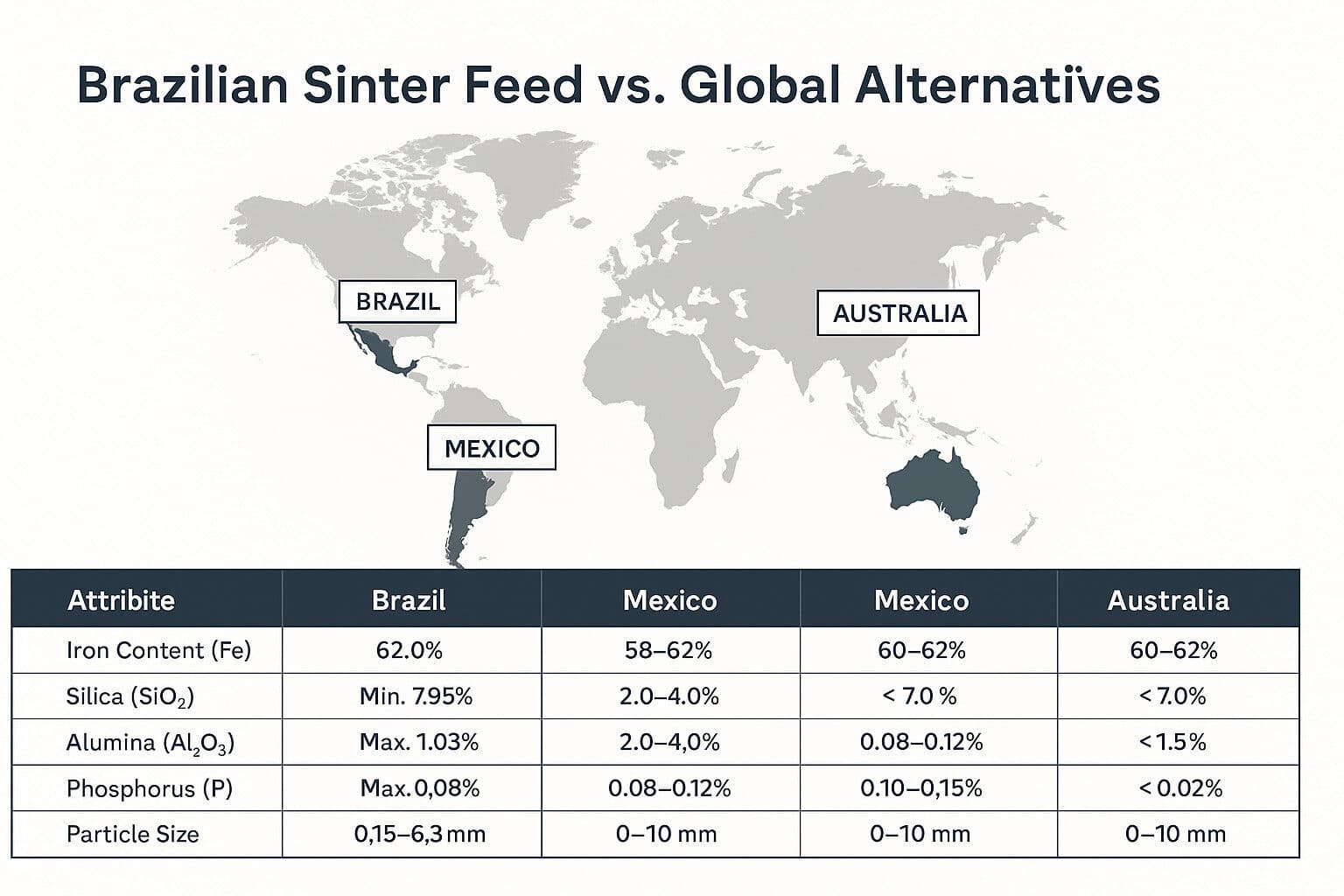

1. Quality Leadership: Brazilian Sinter Feed vs. Global Alternatives

Brazilian sinter feed maintains a competitive edge through high Fe content and low impurity levels, both critical for efficient blast furnace and sintering operations:

- Iron Content (Fe): A minimum of 62.0% Fe, with many mines exceeding 65%, providing stronger metallurgical recovery.

- Low Impurities: Silica (SiO₂ ≤ 7.9%), Alumina (Al₂O₃ ≤ 1.0%), Phosphorus (P ≤ 0.06%), and Sulphur (S ≤ 0.08%)—resulting in reduced slag formation and improved coke efficiency.

- Particle Size: Consistently maintained between 0.15–6.3 mm, ideal for stable sinter bed permeability.

Global Comparison:

- Mexican fines: Typically, 58–62% Fe with higher alumina (2.0–4.0%) and sulphur (0.10–0.15%), leading to higher fuel consumption and less stable sintering.

- Indian fines: Average 58–61% Fe and higher silica, requiring beneficiation or blending to reach similar sinter quality.

- Australian fines: While high Fe (60–62%), often have higher phosphorus levels, impacting steel grade quality.

2. Diverse Product Portfolio

Brazilian producers offer tailored iron ore products for different stages of steelmaking:

- Lumps: 6.3–31.5 mm; 58–66% Fe; low silica; directly usable in blast furnaces with minimal preparation.

- Fines: <6.3 mm; 55–65% Fe; suitable for sintering or pelletizing.

- Pellet Feed: Ultra-fine (<0.15 mm), high Fe (65–68%), minimal impurities; used for high-quality pellets feeding Direct Reduced Iron (DRI) plants and blast furnaces.

Market Note: Pellet feed from Brazilian mines has seen increased demand in 2025 due to growing global DRI production targeting lower CO₂ emissions.

3. Logistics & Freight Economics: The Capesize Advantage

Brazil’s deepwater ports (Ponta da Madeira, Tubarão, Itaqui) are engineered for Capesize vessels, enabling:

- Economies of Scale: 180,000–190,000 MT cargoes reduce freight cost per ton compared to Panamax shipments (~50,000 MT).

- Direct Access to China: Despite longer distances (21–22 days voyage vs. ~10 days from Australia), Capesize efficiency narrows the freight gap, making Brazilian ore competitive.

- Qingdao discharge: Requires minimum 30,000 MT/day discharge rate to avoid demurrage and keep costs aligned.

2025 Freight Data:

- Brazil → Qingdao Capesize freight averages USD 26–29/ton, Panamax routes cost USD 36–40/ton, making Capesize contracts structurally advantageous for long-term offtake.

4. Global Supply and Export Performance

- 2025 Output: Brazil is forecast to export ~400 million MT of iron ore, representing ~22% of global seaborne trade.

- Top Buyers: China (60%), Japan (10%), South Korea (8%), followed by Europe and MENA regions.

- Leading Producers: Vale remains the largest, with a growing emphasis on high-grade and pellet feed products in response to decarbonization in steelmaking.

5. Commercial Framework: Security and Benchmarking

To ensure transparency and mitigate counterparty risk, Brazilian iron ore contracts typically include:

- Price Index: Platts IODEX 62% Fe CFR Qingdao, with quality premiums/discounts applied for higher Fe or impurity deviations.

- Payment Terms:

- 95% upon Bill of Lading with SGS/Bureau Veritas certificates and shipping docs.

- 5% adjusted against final CIQ assay upon arrival.

- Financial Instruments: Irrevocable Documentary Letter of Credit (DLC) from top-tier international banks (Hong Kong, Singapore), with Brazilian banks requiring correspondent approvals for mainland Chinese DLCs.

Strategic Implications for Buyers

- Consistent Quality: Reduced need for blending, stable sintering, and improved furnace efficiency.

- Sustainability: Higher Fe ore lowers coke consumption and CO₂ emissions, aligning with green steel initiatives.

- Long-term Viability: Established infrastructure, deepwater terminals, and proven export reliability.

Brazil’s iron ore offering, underpinned by high-grade sinter feed, scalable Capesize logistics, and transparent commercial practices, remains a cornerstone for steelmakers worldwide seeking efficiency, security, and lower carbon intensity in their raw material procurement.