Sugar Trading Guide: Strategies for Maximizing Profits

Sugar trading is a lucrative market with vast potential for profitable transactions. Whether you are an aspiring sugar commodity broker or a seasoned trader, understanding the intricacies of the sugar market and implementing effective trading strategies is essential for success. In this comprehensive guide, we will explore key steps and strategies to help you navigate the sugar trading landscape and maximize your profits.

Understanding the Sugar Market

To excel in sugar trading, it is crucial to have a solid understanding of the market dynamics and factors that influence prices. Here are some key aspects to consider:

1. Sugar Types: Familiarize yourself with different sugar types, including raw sugar, white sugar, and refined sugar. Each type has its own characteristics and market demand.

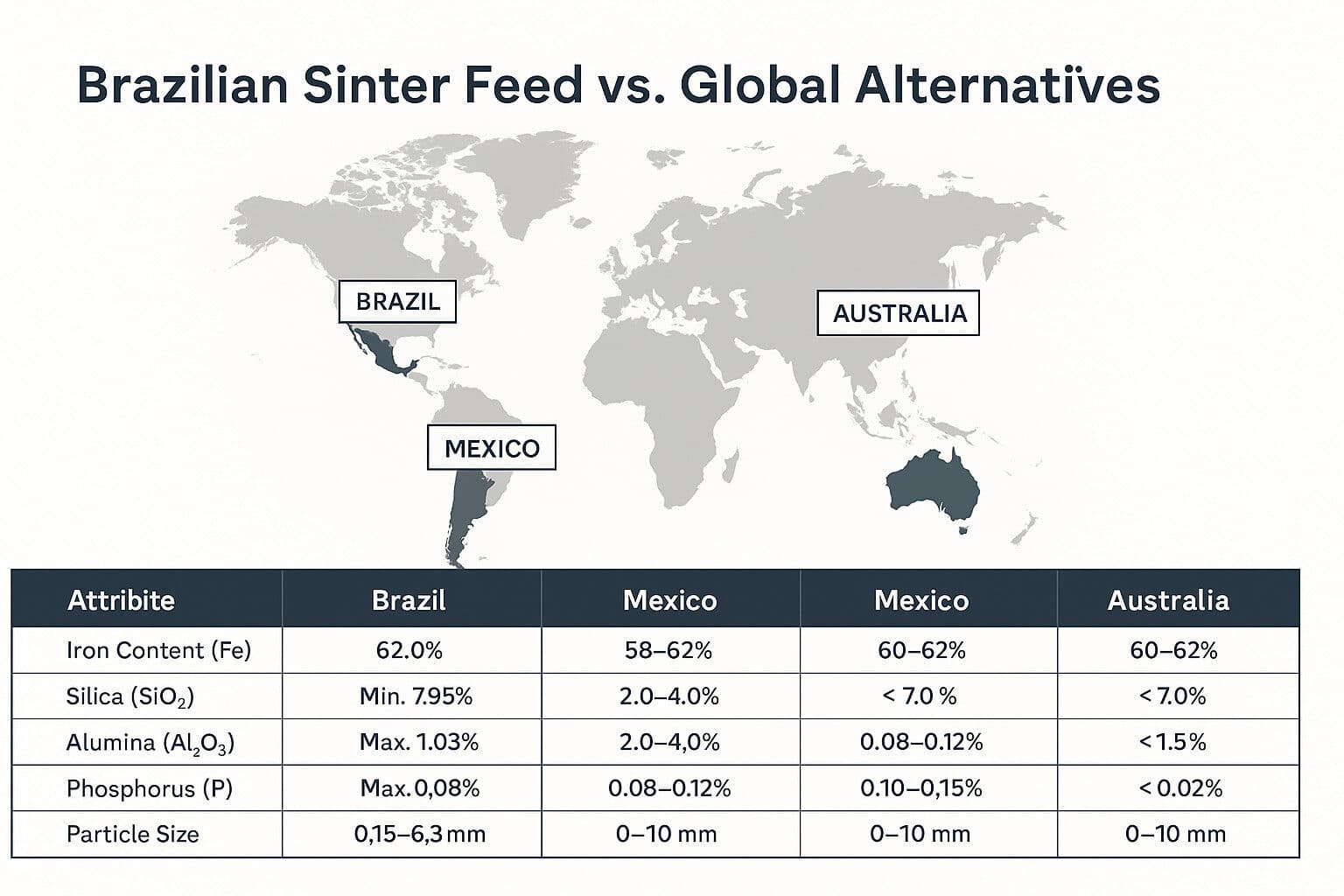

2. Production Regions: Gain knowledge about major sugar-producing regions such as Brazil, India, and the European Union. Understanding production trends and regional dynamics can help you anticipate market movements.

3. Pricing Mechanisms: Stay updated on pricing mechanisms, including futures contracts, spot prices, and global benchmark prices. These mechanisms play a significant role in determining sugar prices.

4. Market Trends: Keep a close eye on market trends, including consumption patterns, trade policies, and regulatory frameworks. These factors can impact supply and demand dynamics, ultimately affecting sugar prices.

Developing Industry Knowledge and Expertise

To succeed in sugar trading, it is essential to continuously enhance your industry knowledge and expertise. Consider the following steps:

1. Commodity Trading Education: Enroll in courses or obtain certifications related to commodity trading, market analysis, and risk management. This will provide you with a solid foundation to make informed trading decisions.

2. Industry Events and Networking: Attend conferences, seminars, and networking events focused on sugar trading and commodities. These platforms offer opportunities to learn from industry experts, exchange ideas, and expand your professional network.

Implementing Profitable Trading Strategies

To maximize profitability in sugar trading, it is crucial to develop and implement effective trading strategies. Here are some strategies to consider:

1. Technical Analysis: Utilize technical analysis tools and indicators to identify price patterns, trends, and potential entry and exit points. This approach can help you make informed trading decisions based on historical price data.

2. Fundamental Analysis: Stay updated on fundamental factors that impact sugar prices, such as weather conditions, government policies, and global demand. Analyzing these factors can help you anticipate market movements and make strategic trading decisions.

3. Risk Management: Implement robust risk management strategies to mitigate potential losses. This includes setting stop-loss orders, diversifying your portfolio, and managing leverage effectively.

Trading sugar can be a profitable venture if you have a comprehensive understanding of the market dynamics and employ effective trading strategies. In this guide, we will provide you with an overview of sugar trading, including the instruments available, risk assessment, and essential steps to embark on your sugar trading journey.

Understanding Sugar Trading Instruments

To gain exposure to sugar prices, traders can utilize various instruments:

Sugar Futures: These contracts oblige the buyer to purchase a specified quantity of sugar at a predetermined price on a future date. Futures contracts are traded on futures exchanges.

Sugar Options: These contracts grant the buyer the right, but not the obligation, to buy or sell sugar at a specified price on or before a specified date. Options contracts offer flexibility and the potential to limit losses.

Sugar ETFs (Exchange-Traded Funds): These ETFs track sugar price indices, providing investors with diversified exposure to the sugar market without direct ownership of physical sugar.

Assessing the Risks of Sugar Trading

Before diving into sugar trading, it’s crucial to consider the inherent risks involved:

Price Volatility: Sugar prices are subject to significant fluctuations due to supply and demand dynamics, weather events, and global economic factors [1].

Margin Requirements: Futures and options trading require margin deposits, acting as collateral to cover potential losses. Traders must maintain sufficient margin to avoid margin calls and forced liquidations.

Regulatory Compliance: Sugar trading is subject to regulations imposed by government agencies and exchanges. Traders must adhere to these regulations to avoid legal repercussions.

Embarking on Your Sugar Trading Journey

To successfully navigate the sugar trading arena, follow these essential steps:

Educate Yourself: Gain a thorough understanding of sugar market dynamics, trading instruments, and risk management strategies. Utilize books, online courses, and webinars to enhance your knowledge base.

Choose a Reputable Broker: Select a regulated and experienced broker that offers sugar trading services. Consider factors like brokerage fees, trading platforms, and customer support.

Open a Trading Account: Once you’ve selected a broker, open a trading account and fund it with sufficient capital. Start with smaller positions and gradually increase your trade size as you gain experience.

Develop a Trading Plan: Establish a comprehensive trading plan that outlines your risk tolerance, trading objectives, and entry and exit strategies. Utilize technical analysis tools and fundamental analysis to identify potential trading opportunities.

Practice Risk Management: Implement strict risk management practices to mitigate potential losses. Set stop-loss orders to limit potential losses and employ position sizing techniques to control your overall risk exposure.

Monitor Market Developments: Continuously monitor global economic news, weather reports, and sugar market trends to make informed trading decisions. Stay abreast of factors that could influence sugar prices.

Seek Guidance: Seek guidance from experienced traders and market analysts to gain valuable insights and refine your trading strategies.

Understanding Documentation and Procedures in Sugar Trading

To ensure a professional understanding of documentation and procedures in sugar trading, it is important to familiarize yourself with the various documents and processes involved. This includes analyzing SGS reports, executing Impfa agreements, entering into NCNDA agreements, obtaining ICPOs, and adhering to KYC compliance.

SGS Reports:

SGS (Société Générale de Surveillance) reports are essential in assessing the quality and quantity of sugar shipments. These reports help ensure compliance with contractual specifications. It is important to analyze these reports thoroughly to make informed decisions regarding sugar trading.

Impfa (Irrevocable Master Fee Protection Agreement):

Impfa agreements are crucial in protecting brokerage fees and commissions in sugar transactions. These agreements outline the terms and conditions governing compensation. By executing Impfa agreements, you can safeguard your financial interests and ensure fair compensation for your services.

NCNDA (Non-Circumvention, Non-Disclosure Agreement):

NCNDA agreements are important in maintaining confidentiality and preventing circumvention of brokerage relationships. By entering into NCNDA agreements with clients and partners, you can protect sensitive information and maintain the integrity of your business relationships.

ICPO (Irrevocable Corporate Purchase Order):

Obtaining ICPOs from buyers is a crucial step in formalizing purchase orders in sugar trading. ICPOs specify the terms of the transaction, including product specifications, pricing, and delivery details. It is important to obtain and review ICPOs to ensure clarity and agreement on the terms of the sugar transaction.

KYC (Know Your Customer) Compliance:

Adhering to KYC requirements is essential in sugar trading. Conducting due diligence on clients and counter parties helps verify their identity, legitimacy, and compliance with regulatory standards. By adhering to KYC compliance, you can mitigate risks associated with fraudulent activities and ensure a transparent and compliant trading process.

Ensuring Compliance and Risk Management

In addition to understanding the documentation and procedures involved in sugar trading, it is crucial to prioritize compliance and risk management. This involves adhering to legal and regulatory requirements and implementing robust risk management strategies.

Legal and Regulatory Compliance:

Stay vigilant about legal and regulatory requirements governing sugar trading. This includes compliance with trade sanctions, import/export regulations, and quality standards. By staying informed and up-to-date on these requirements, you can ensure a compliant trading process.

Risk Management Strategies:

Implementing robust risk management strategies is essential in mitigating exposure to market volatility, credit risk, and operational challenges. This may involve diversifying your portfolio, setting risk limits, and closely monitoring market trends. By proactively managing risks, you can protect your investments and optimize your trading outcomes.